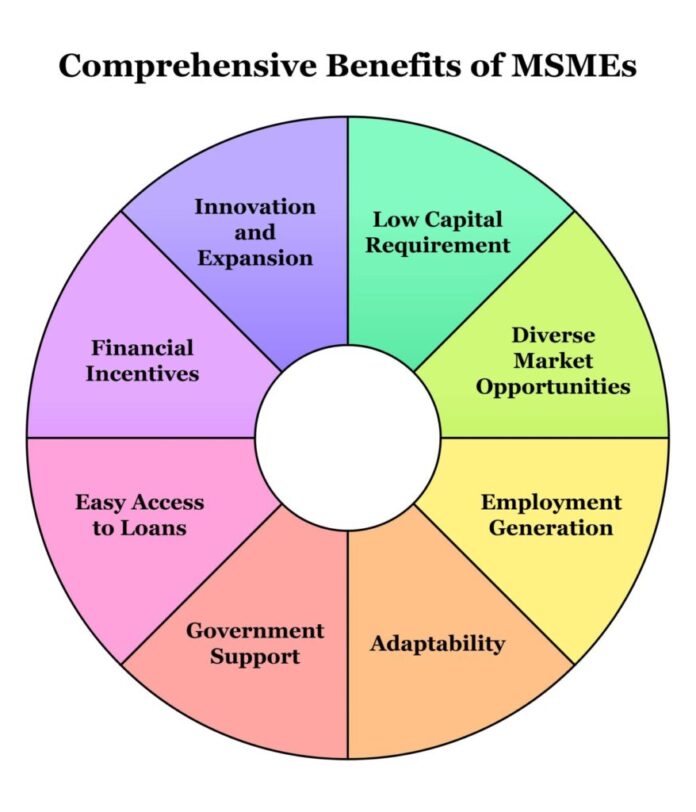

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India’s economy. They generate jobs, fuel innovation, and strengthen communities by supporting local production and services. Despite their smaller scale, MSMEs contribute significantly to India’s GDP and exports. Understanding their value is important for entrepreneurs, policymakers, and anyone aiming to build sustainable growth. This post explains the MSME benefits that help businesses expand and thrive. From easier access to finance to government-backed support, MSMEs enjoy advantages that make them vital to India’s progress.

Role of MSMEs in India

MSMEs play a crucial role in balancing growth across rural and urban India. They provide job opportunities, reduce dependence on large corporations, and create a supportive ecosystem for entrepreneurs.

Employment generation

A key contribution of MSMEs is their ability to generate large-scale employment with modest investments. This widens opportunities for youth and women, especially in semi-urban and rural areas. According to official reports, MSMEs employ over 110 million people in India, making them one of the largest employers in the country.

Regional development

MSMEs often set up operations in underdeveloped areas. This spreads economic activity beyond major cities, encouraging inclusive growth. For many regions, MSMEs are the first to provide stable income and opportunities for entrepreneurship.

Financial MSME Benefits

Access to finance is one of the most substantial advantages of MSME registration.

Easier access to credit

Registered MSMEs can apply for government schemes that provide collateral-free loans. These schemes alleviate the financial burden and facilitate smooth operation.

Subsidised interest rates

Many MSMEs qualify for lower interest rates on loans. These benefits lower repayment costs and free up working capital. For example, schemes under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provide significant support.

Quicker approval processes

Banks and financial institutions prioritise registered MSMEs. This often translates to faster loan approvals, ensuring timely access to funds when urgent business needs arise.

Support through Government Schemes

Government initiatives provide MSMEs with structured support to compete effectively.

Priority in tenders

Registered MSMEs get preference in government tenders. This opens new opportunities for growth and stability, especially for businesses that provide goods and services in bulk.

Protection against delayed payments

The law protects MSMEs against delayed payments from buyers. This ensures better cash flow and reduces financial stress, enabling firms to focus on growth rather than collections.

Technology and training support

Several schemes help MSMEs upgrade technology and improve workforce skills. These initiatives enhance productivity and competitiveness, enabling MSMEs to compete effectively with larger firms.

Non-Financial MSME Benefits

Beyond money matters, MSMEs enjoy operational and market advantages.

Brand credibility

MSME registration adds legitimacy to a business. It signals reliability to lenders, partners, and customers, creating trust in both domestic and international markets.

Access to subsidies and rebates

Registered MSMEs can claim subsidies on electricity, patents, and industrial promotion. These reduce operational costs and facilitate expansion. Rebates on ISO certification and patent registration are further incentives.

Global opportunities

MSMEs can participate in international fairs and export promotion schemes. This expands their reach beyond domestic markets and helps them build stronger global networks.

Why Entrepreneurs Value Business Loan Options

Finance plays a significant role in the success of any MSME.

Fuel for expansion

A Business Loan allows entrepreneurs to purchase new equipment, open new branches, or scale production. Without external funding, expansion may remain out of reach for many MSMEs.

Working capital support

Loans provide stability during lean months by covering essential expenses such as salaries, raw materials, and utility bills. Access to a Business Loan ensures that operations continue without disruption.

Building resilience

With the right Business Loan, MSMEs can prepare for challenges, invest in innovation, and secure long-term growth. Whether it is seasonal demand shifts or sudden market opportunities, adequate finance builds confidence.

Challenges Faced by MSMEs

Despite the advantages, MSMEs face hurdles that need careful attention.

- Limited awareness of schemes and registration benefits

- Inadequate infrastructure in rural areas

- Difficulty in adopting advanced technologies

- Compliance requirements that add to operating costs

These challenges underscore the need for ongoing reforms, targeted awareness campaigns, and enhanced support systems. Overcoming them will make MSMEs even more substantial contributors to India’s economy.

Conclusion

MSMEs are vital to India’s growth story. They generate employment, empower rural communities, and create opportunities for entrepreneurs across the nation. The wide range of MSME benefits, from easier access to finance to priority in government tenders, make them a cornerstone of inclusive development. For entrepreneurs, recognising the importance of these advantages is the first step toward sustainable growth. With the right strategies, and access to tools like a Business Loan, MSMEs can continue to innovate, expand, and contribute significantly to India’s economy. Their impact goes far beyond profits, shaping livelihoods and strengthening the country’s economic foundation.