There are several types of trading segments in the stock market. One of them is Futures and Options (F&O) trading.

F&O allows you to speculate on the price movements of stocks, commodities, or indices, without having to own the underlying asset.

For beginners, understanding the meaning of futures and options and its basics is crucial before getting into this more advanced trading strategy.

What are Futures and Options?

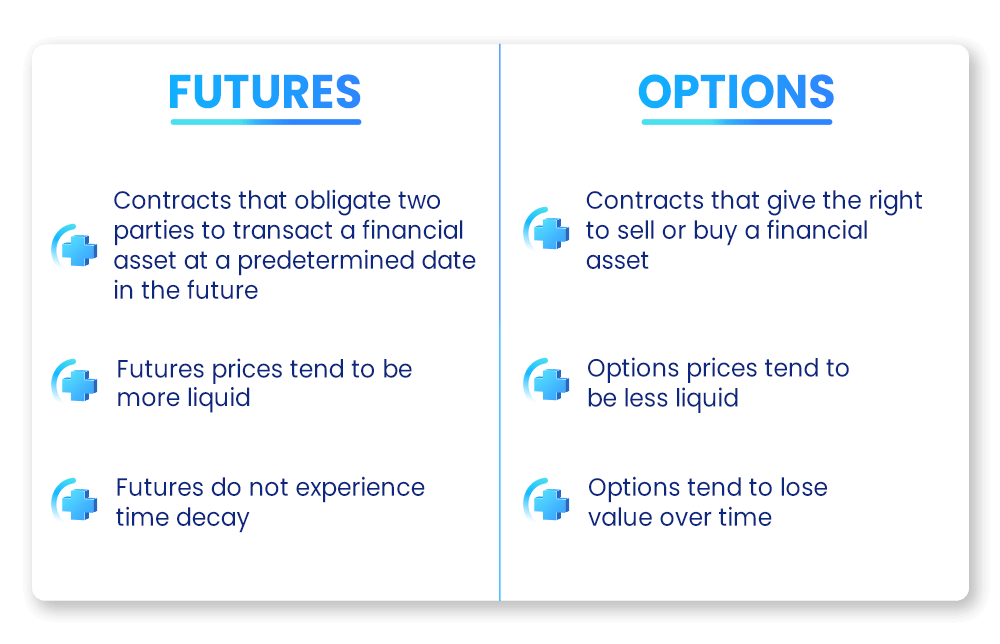

Both futures and options are types of derivatives. As such, their value is derived from an underlying asset such as a stock, commodity, or index.

- Futures

A futures contract allows you to sell or buy the underlying asset at a specified price on a predetermined future date. When you buy a futures contract, you agree to purchase the underlying asset in the future at the set price, regardless of the market price at that time. Similarly, selling a futures contract means you agree to sell the asset at a fixed price on the specified date.

- Options

This gives you the types of options to buy or sell the underlying asset at a predetermined price before or on a specific date. While you pay a premium for this right, you are not obligated to go through with the transaction if you do not find it profitable by the expiry date.

How Does Futures and Options Trading Work?

In F&O trading, the goal is to predict the future price of an asset and profit from its price movement. Here’s how each works:

- Futures Trading

If you believe the price of a stock or commodity will rise, you can enter into a futures contract to buy at today’s price and sell it at the future price to make a profit. Conversely, if you think the price will fall, you can sell a futures contract and buy it back at a lower price in the future.

- Options Trading

If you think the price of an asset will rise, you can buy a call option. If the price goes beyond the strike price (the price specified in the option), you can buy the asset at the lower price and either sell it for a profit or hold it. If you think the price will fall, you can buy a put option, which gives you the right to sell the asset at the agreed price even if the market price drops.

Tips for Beginners in F&O Trading

- Start Small: Begin by trading small contracts or options with a lower risk to get a feel of F&O trading.

- Understand Your Risk: Understand the maximum amount you can afford to lose in any trade and don’t risk anything more than that.

- Learn About Hedging: Options can be used to hedge against potential losses in other parts of your portfolio. This strategy can help reduce risk in volatile markets.

- Stay Updated: Follow market trends, global economic news, and factors that may affect stock prices, like earnings reports and government policies.

Conclusion

F&O trading offers an exciting way to leverage price movements and potentially earn profits without owning the underlying asset.

However, these instruments also carry significant risks, especially for beginners. By understanding the futures and options meaning mastering key terms, and starting cautiously, you can gradually develop the skills and knowledge to navigate the F&O market successfully.

Always remember to stay informed, manage your risks effectively, and continuously learn from your trading experiences.