Price Trend of Rebar: A Comprehensive Analysis

Rebar, or reinforcing bar, is a crucial component in the construction industry, playing a key role in reinforcing concrete structures. With its high tensile strength, rebar ensures that concrete can withstand tension and stress, making it indispensable for projects ranging from residential buildings to infrastructure and large-scale industrial constructions. Understanding the price trend of rebar is vital for businesses, contractors, and builders to forecast material costs and optimise project budgets.

This article provides an in-depth analysis of the key factors influencing rebar prices, historical price trends, current market conditions, and future price predictions. By understanding these aspects, industry stakeholders can make informed decisions, adapt to changing market conditions, and better manage production and procurement strategies.

Key Factors Influencing Rebar Prices

The price of rebar is influenced by several factors, including raw material costs, energy prices, supply and demand dynamics, and geopolitical conditions. Understanding these key drivers is essential for comprehending the overall price trends in the rebar market.

1. Raw Material Costs

The primary raw materials used in rebar production are iron ore, scrap metal, and alloying elements such as carbon and manganese. The price of these materials has a direct impact on the cost of rebar. Fluctuations in the global supply and demand for these raw materials, as well as changes in mining and recycling rates, can lead to price volatility in the rebar market.

- Iron Ore: Iron ore is the key raw material used in the production of steel, which is then turned into rebar. The price of iron ore, which is primarily affected by global supply and demand, is a significant factor in determining rebar prices. Any disruptions in iron ore production, such as those caused by natural disasters or mining restrictions, can lead to price hikes.

- Scrap Metal: Scrap steel is increasingly being used in rebar production due to its lower cost compared to virgin iron ore. The availability of scrap metal, as well as its price, plays a crucial role in the overall rebar price structure. In regions with abundant scrap metal supply, rebar prices tend to be more stable.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/rebar-price-trends/pricerequest

2. Energy Costs

Rebar production is an energy-intensive process, particularly in the melting and casting stages. Energy costs, including electricity and natural gas, contribute significantly to the overall cost of rebar production. Fluctuations in global energy prices, driven by geopolitical factors, supply-demand imbalances, or regulatory changes, can influence rebar prices.

- Electricity: Rebar mills require large amounts of electricity to power electric arc furnaces (EAF), which are commonly used to melt scrap metal. Any increase in electricity prices, whether due to higher demand or regulatory changes, can drive up rebar production costs.

- Natural Gas: Natural gas is another energy source used in rebar production, particularly for heating and processing. Energy price fluctuations, particularly in regions where natural gas is a key energy source, can impact rebar costs.

3. Supply and Demand Dynamics

The balance between supply and demand is one of the most important drivers of rebar prices. Demand for rebar is closely linked to the construction industry, which itself is influenced by factors such as economic growth, government infrastructure spending, and construction activity.

- Construction Sector Demand: Rebar is primarily used in the construction of reinforced concrete structures. Therefore, the demand for rebar is closely tied to the health of the construction industry. When construction activity increases—such as during periods of infrastructure development or urban expansion—demand for rebar tends to rise, leading to price increases.

- Infrastructure Projects: Large-scale infrastructure projects, such as bridges, highways, and high-rise buildings, require vast amounts of rebar. Government stimulus programs aimed at boosting infrastructure spending can lead to a spike in rebar demand, pushing up prices.

- Geographic Variations in Demand: Demand for rebar can vary greatly by region. For example, in emerging markets where rapid urbanization and infrastructure projects are underway, the demand for rebar may be more pronounced, driving prices up. Conversely, in regions with slow construction growth, prices may remain relatively stable or even decrease.

4. Geopolitical and Economic Factors

Global geopolitical factors, including trade policies, tariffs, and international relations, can have a significant impact on the price of rebar. The steel industry is highly international, with global supply chains involving numerous countries and regions.

- Trade Policies and Tariffs: Tariffs imposed on steel imports, especially by major producers like the United States or European Union, can disrupt the rebar market by increasing the cost of imported materials. For instance, a tariff on Chinese steel imports could lead to higher rebar prices in countries dependent on Chinese steel imports.

- Economic Growth and Recession: The economic outlook of major economies plays a crucial role in shaping construction activity and, by extension, rebar demand. In times of economic growth, infrastructure investments and residential/commercial construction projects increase, leading to higher rebar demand and prices. On the other hand, during economic downturns or recessions, demand for rebar may fall, leading to price reductions.

5. Currency Fluctuations

Rebar is traded globally, and its price is often denominated in US dollars. As such, currency exchange rates can influence the price of rebar in different markets. For countries with a weak domestic currency relative to the US dollar, the cost of importing rebar becomes more expensive, which may result in higher local prices. Conversely, a strong domestic currency can help reduce the cost of imports, potentially lowering rebar prices in those markets.

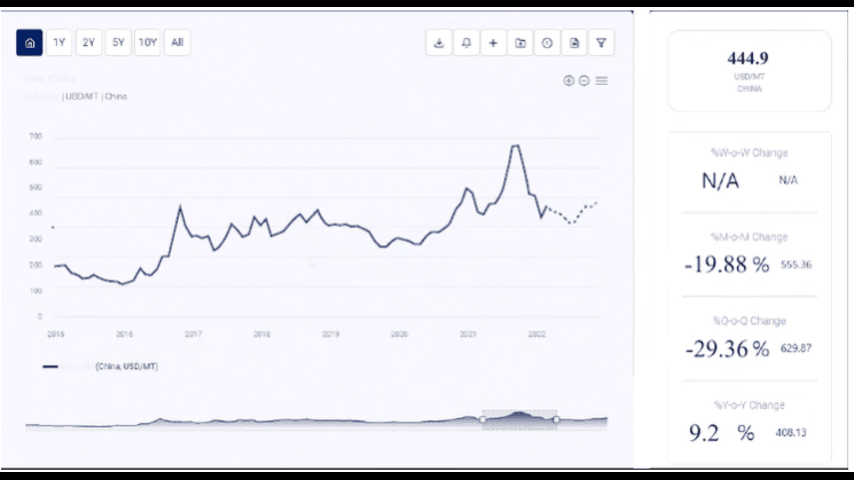

Historical Rebar Price Trends

Historically, rebar prices have shown significant fluctuations, primarily driven by changes in raw material costs, energy prices, and market demand. Some of the key historical price trends include:

Pre-Global Financial Crisis (2000-2007)

Before the global financial crisis, rebar prices generally experienced steady growth. The early 2000s were marked by a strong demand for steel, driven by booming construction activity in emerging markets like China and India. This led to higher prices for steel products, including rebar.

Global Financial Crisis (2008-2009)

The global financial crisis caused a sharp decline in demand for construction materials, leading to a significant drop in rebar prices. With the construction sector hit hard by the economic downturn, many steel producers reduced their production capacity, which contributed to a temporary reduction in prices.

Post-Crisis Recovery (2010-2014)

Following the global financial crisis, rebar prices began to recover as construction activity in developing countries surged. China, in particular, played a significant role in driving up demand for rebar during this period, as the country continued to urbanize rapidly and invest heavily in infrastructure.

Price Volatility (2015-2020)

Between 2015 and 2020, rebar prices showed significant volatility, reflecting global economic uncertainties, supply-demand imbalances, and fluctuations in raw material prices. For instance, in 2017 and 2018, rebar prices surged due to strong demand from the Chinese construction sector, combined with higher iron ore prices. However, in 2019 and 2020, prices were affected by trade tensions, tariffs, and the economic impact of the COVID-19 pandemic, which led to supply chain disruptions and reduced construction activity in many regions.

Current Market Situation

As of recent data, the global rebar market is experiencing a phase of price stability with a slight upward trend, driven by robust demand from key sectors such as construction, infrastructure development, and industrial projects. While the effects of the pandemic are still being felt in certain regions, the construction sector is showing signs of recovery in major economies, including the United States, Europe, and parts of Asia.

Key market factors currently influencing rebar prices include:

- Increased Infrastructure Spending: Governments worldwide are increasing their infrastructure budgets, which is leading to higher demand for rebar. In the United States, for example, the passing of large infrastructure bills has resulted in more demand for steel products like rebar.

- Raw Material Price Increases: Iron ore and scrap metal prices have been volatile, contributing to occasional increases in rebar prices. Fluctuations in global supply chains, particularly in iron ore production in countries like Brazil and Australia, have been a major contributing factor to price swings.

- Energy Prices: Energy price hikes, particularly in natural gas and electricity, are adding pressure to rebar production costs. These increases are often passed down the supply chain, leading to higher rebar prices.

Future Rebar Price Forecast

Looking ahead, several factors will continue to shape the price trajectory of rebar:

1. Increased Construction Activity

The ongoing global push for infrastructure investment, particularly in the wake of the COVID-19 pandemic, will likely keep demand for rebar strong. As economies recover, construction activity, especially large-scale infrastructure projects, is expected to continue driving up rebar prices.

2. Raw Material Price Fluctuations

As iron ore and scrap metal prices remain volatile, fluctuations in raw material costs will continue to affect rebar pricing. In particular, global supply chain issues and disruptions in mining operations could cause short-term spikes in rebar prices.

3. Geopolitical Factors and Trade Policies

The imposition of trade tariffs, particularly in key markets like the United States, could continue to impact the cost of imported rebar. Similarly, political instability or trade disputes among major steel producers may influence global pricing trends.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA